|

How India could rise to the world’s second-biggest economyTime:2023-10-29

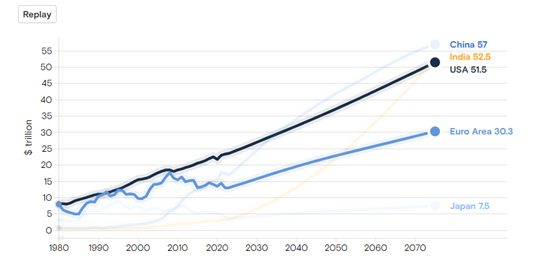

As India’s population of 1.4 billion people becomes the world’s largest, its GDP is forecast to expand dramatically. Goldman Sachs Research projects India will have the world’s second-largest economy by 2075.

For India, a key to realizing the potential of that growing population is boosting participation within its labor force, as well as providing training and skills for its immense pool of talent, says Santanu Sengupta, Goldman Sachs Research’s India economist. “Over the next two decades, the dependency ratio of India will be one of the lowest among regional economies”, he says, pointing out that India’s population has one of the best ratios between its working-age population and its number of children and elderly. “So that really is the window for India to get it right in terms of setting up manufacturing capacity, continuing to grow services, continuing the growth of infrastructure.” India is forecast to have the world's second-largest economy by 2075GDP level projections in real (2021) USD trillion

What are the key drivers of the Research Department's long-term forecast for the Indian economy? India has made more progress in innovation and technology than some may realize. Yes, the country has demographics on its side, but that’s not going to be the only driver of GDP. Innovation and increasing worker productivity are going to be important for the world’s fifth-biggest economy. In technical terms, that means greater output for each unit of labor and capital in India’s economy. Capital investment is also going to be a significant driver of growth going forward. Driven by favorable demographics, India’s savings rate is likely to increase with falling dependency ratios, rising incomes, and deeper financial sector development, which is likely to make the pool of capital available to drive further investment.

What are the risks to the Research Department’s forecasts for India’s economic growth?

The main downside risk is that the labor force participation rate does not improve. India’s labor force participation rate has declined over the past 15 years. If you have more opportunities—especially for women, since women's labor force participation rates are significantly lower than men—you can increase your labor force participation rate, which can further increase your potential growth.

The upside to growth can come through higher productivity growth. India has taken a giant leap in digitizing its economy through wider penetration of the internet and mobile internet. But beyond that, you also have a unique identification number, known as Aadhaar, which is the world's largest biometric ID system, through which you can now verify the identity of 1.4 billion people online and physically. Therefore, it makes the delivery of public services easier and more targeted. It widens the credit network, leading to greater access to credit for small businesses, which can provide upside to growth through increased productivity.

What are the other key factors to understand the Indian economy?

China is a very domestic demand-driven economy compared to many other countries, especially in areas that are more dependent on exports. India's growth so far has been driven primarily by domestic consumption, which accounts for about 55-60% of the overall economy, coupled with domestic investment.

Net exports have been a drag on economic growth as India runs a current account deficit. Recently, we have seen some progress in this regard. Exports of services have been increasing, which has cushioned the current account balance to some extent.

Another important factor to remember is how commodity prices affect the macroeconomy – inflation, fiscal deficits and current account deficits. India imports most of the goods required by its large population. When global commodity prices rise, it obviously manifests itself as macro imbalances.

Over the past few years, these macro imbalances are reducing and macro vulnerabilities are reducing, one through inflation targeting and two through buffering of current account balances through services exports.

Which commodities are of particular interest for India's current account?

Large populations have their energy needs. Although per capita energy consumption is much lower than not only the Western world but also other emerging economies, a large population means a large energy import bill, which is reflected in India's current account imbalance.

This was even more true about ten years ago. Over the past five years or so, external balance dynamics have become increasingly more resilient due to structural improvements in the current account stemming from services exports and conscious central bank efforts to build reserve buffers, which have provided additional buffers during periods of dollar strength.

Is green energy and energy transition an opportunity for India?

Absolutely. India has announced that it aims to achieve net-zero emissions by 2070 and generate 50% of its power generation capacity from non-fossil energy sources by 2030. The government is also promoting electric vehicles and green hydrogen, and is targeting 500GW of renewable or clean energy capacity by 2030.

Ultimately, the transition to green energy is a huge investment opportunity, but it takes time. During this period, fossil fuels will account for the majority of energy needs until India switches to green energy.

|